610-437-1375

Request A MeetingM Financial believes that performance and cost must be measured over the life of an insurance product, not within in the initial illustration or the first year premium.

M Financial believes that existing policyholders should be treated as well as new policyholders.

M Financial reinsures proprietary products through M Financial Re, its wholly owned reinsurance operation. By investing upwards of $50 million a year in the high quality business placed by its Member Firms, M Financial has access to Partner Carrier pricing assumptions and can effectively track experience, while monitoring changes in policyholder interests.

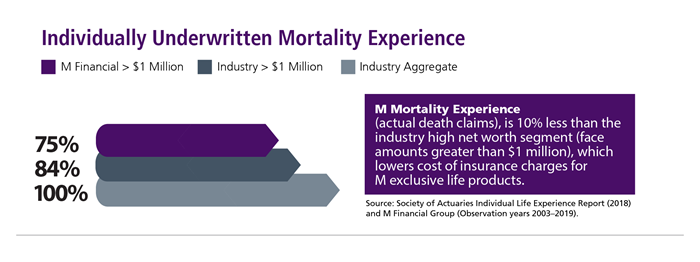

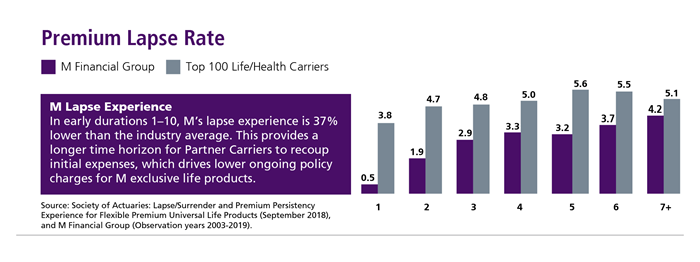

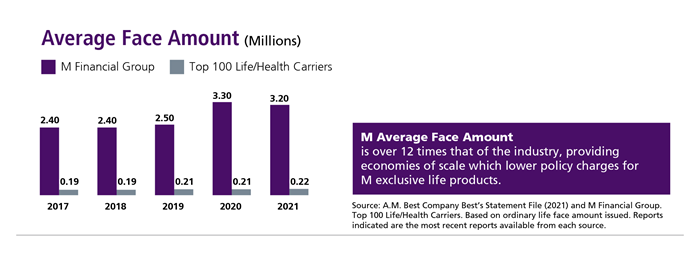

Sharing risk also aligns the interests of M Financial and its Partner Carriers, which facilitates the development—and ongoing management—of products designed to outperform over the long term. Product pricing is driven by three experience components: mortality, persistency, and average face amount. M Financial’s favorable experience creates pricing advantages for Member Firm clients.

When better than expected experience emerges, M Financial works with the Partner Carriers to reprice the products—for both new sales and in-force business.

This approach ensures that existing policyholders receive the value of the repricings, which are created by their superior mortality, persistency, premium volume, and expense experience, while creating an opportunity for new buyers to participate in the enhanced pricing of the product going forward.